Our regularly updated newsletter provides timely articles to help you achieve your financial goals. Please come back and visit often.

Any accounting, business or tax advice

contained in this communication, including attachments and

enclosures, is not intended as a thorough, in-depth analysis of

specific issues, nor a substitute for a formal opinion, nor is it

sufficient to avoid tax-related penalties. If desired, we would be

pleased to perform the requisite research and provide you with a

detailed written analysis. Such an engagement may be the subject of

a separate engagement letter that would define the scope and limits

of the desired consultation services. The Ins and Outs of the Home Office Deduction

The pandemic changed the landscape of work for a lot of people, including the numerous business owners who began running their businesses from their homes. Many are still working from their home offices, whether full-time or on a hybrid basis. If you're self-employed and run your business from home, or perform certain functions there, you might be able to claim deductions for home office expenses against your business income. How to QualifyIn general, self-employed taxpayers qualify for home office deductions if part of their home is used “ regularly and exclusively” as the principal place of business. If your home isn't your principal place of business, you may still be able to deduct home office expenses if:

Keep in mind the requirement that the space be used exclusively for business. For example, if your home office is also a guest bedroom, you can't deduct the entire space as a home office expense. But if you use the desk area of the room exclusively for business, you can deduct that portion of the room, as long as you otherwise qualify. Expenses You Can DeductMany eligible taxpayers deduct actual expenses when they claim home office deductions. Deductible home office expenses may include:

But keeping track of actual expenses can take time, and it requires organized recordkeeping. The Simpler MethodFortunately, there's a simplified method: You can deduct $5 for each square foot of home office space, up to $1,500. The cap can make the simplified method less valuable for larger home office spaces. Even for small spaces, taxpayers may qualify for bigger deductions using the actual expense method. So tracking your actual expenses can be worth it. When claiming home office deductions, you're not stuck with a particular method. For instance, you might have chosen the actual expense method when you filed your 2022 return, but then use the simplified method when you file your 2023 return next year, and the following year switch back to the actual expense method. The choice is yours. More ConsiderationsThe amount of your deductions is subject to limitations based on the income attributable to your use of the office. Other rules and limitations may apply. But eligible home office expenses that can't be deducted because of these limitations can be carried forward and may be able to be deducted in later years. Also be aware that, if you sell a home on which you claimed home office deductions, there may be tax implications. Contact us for more information. A Valuable DeductionYou might be wondering why only business owners and the self-employed have been addressed here. Unfortunately, the Tax Cuts and Jobs Act suspended home office deductions from 2018 through 2025 for employees, even if you're currently working from home because your employer doesn't provide office space. But the home office deduction can be valuable to those who're eligible for it. We can help you determine if you're eligible and the best method for claiming the deduction in your situation. © 2023  Moving Out of State? Learn All the Tax Implications First

With so many people working remotely these days, thinking about moving to another state has become common — perhaps for better weather or to be closer to family. Business owners might contemplate selling their business as part of an out-of-state move. Many retirees also look at moving to a state with a lower cost of living to stretch their retirement savings. If you've found yourself harboring such notions, be sure to consider taxes before packing up your things. What Taxes Apply?It may seem like a no-brainer to simply move to a state with no personal income tax, but you must consider all taxes that can potentially apply to state residents. In addition to income taxes, these may include property taxes, sales taxes, and estate or inheritance taxes. If the states you're considering have an income tax, look at what types of income they tax. Some states, for example, don't tax wages but do tax interest and dividends. And some states offer tax breaks for pension payments, retirement plan distributions and Social Security payments. What Are the Domicile Requirements?If you make a permanent move to a new state and want to escape taxes in the state you came from, it's important to establish legal domicile in the new location. Generally, your domicile is a fixed and permanent home location where you plan to return, even after periods of residing elsewhere. Each state has its own rules regarding domicile. You don't want to wind up in a worst-case scenario: Two states could claim you owe state income taxes if you established domicile in the new state but didn't successfully terminate domicile in the old one. Additionally, if you die without clearly establishing domicile in just one state, both the old and new states may claim that your estate owes income taxes and any state estate tax due. The first step to establishing domicile is to buy or lease a home in the new state and, generally, to sell your previous home (or rent it out at market rates to an unrelated party). Then, change your mailing address on bank and investment accounts, insurance policies and other important documents. Getting a driver's license in the new state and registering your vehicle there also helps. So does registering to vote there and becoming involved with local organizations and activities. Be sure to take these and other steps as soon as possible after moving. Keep in mind that there may be rules about the number of days spent in the state. So, you may have to do more than take the steps above to show that you're domiciled in the new state. How Might State Taxes Affect a Business Sale?Business owners tend to focus on the federal tax implications of a sale, while they may ignore state taxes. Now that federal tax rates are lower than they've been in the past, state taxes may take on added significance. If you're contemplating relocating or retiring to another state, it may make sense to consider moving before you sell the business — especially if the new state has low, or even no, income tax. To successfully negotiate the sale of a business, it's critical to understand all the tax implications. Armed with this knowledge, you can assess the impact that moving to another state would have on your net proceeds from the sale and whether it would be better to sell the business before or after you move. Need Help?When looking into whether the grass is greener in another state, do some research and contact the office for help avoiding unpleasant tax surprises. © 2023  Don’t Get Carried Away by a Windfall

Receiving a sudden and sizable influx of cash may seem like a dream come true. It can be, but many people get carried away and end up in worse financial shape. If you're hit with a financial windfall, here are some points you should know. Risky ConditionsYou may be tempted to almost immediately make an expensive purchase, such as a luxury car or a vacation home. And friends and family members may expect to share in your bounty, or they may pitch “sure-fire” investment opportunities. Fraudulent charities may also come knocking. You can avoid these potential pitfalls by stashing your windfall in a bank or money market account as soon as you receive it. Let it sit there until you've had some time to think carefully about how to best use the money and you've obtained advice from a qualified professional. Waiting at least a month before you touch the money can help prevent impulse buys and other mistakes. Also, you may owe taxes. Some windfalls, such as lottery winnings and certain legal settlements, are subject to federal tax — as much as 37% federal tax if your windfall pushes you into the top income tax bracket. State and local taxes may apply as well. A tax professional can help you determine what you owe. Shelter From the StormWhat you eventually decide to do with your windfall will depend on many factors. If you have debt, you'll probably want to pay it off — especially if it carries a high interest rate and the interest isn't deductible. Also, establishing or boosting your emergency savings can minimize the need to incur future debt. Next, consider where you'd like to be five, 10 or 20 years into the future. Develop a plan that will help you move toward your goals — whether that means starting a business, retiring early, or something else. You probably shouldn't quit your job without having thought it through carefully. Few windfalls are large enough to see you all the way through retirement (depending on your age). Only after those considerations should you contemplate making any major purchases. If using some of the windfall to buy that new car or vacation home now won't interfere with your financial security and long-term goals, then go for it! Long-Term PlanTo put a windfall to optimal use, a long-term plan is critical. Contact the office for help assessing the tax and other financial implications of your windfall. © 2023  IRS Suspends Processing of New ERC Claims

The IRS is continuing to warn businesses about aggressive marketing by nefarious actors involving the Employee Retention Credit (ERC). It has suspended the processing of ERC claims until at least year end because of a spike in the number of fraudulent claims. The IRS has now issued a series of red flags businesses should bear in mind. Warning signs include:

Eligible employers can claim the ERC on an original or amended employment tax return for qualified wages paid between March 13, 2020, and Dec. 31, 2021. But there are very specific eligibility requirements; careful review is required to determine eligibility. The IRS recommends businesses work with a trusted tax professional.  What Exactly Is a “Small Business”?

Although your business may seem big to you, you may wonder how the government classifies it. A recent report by the Joint Committee on Taxation, a nonpartisan committee of the U.S. Congress, discusses what a “small business” is for tax purposes. As the report states, there’s no one definition of a small business. Instead, different definitions apply depending on the context, various criteria and certain thresholds. Criteria include a business’s gross assets, gross receipts and its number of shareholders and employees. Even if a criterion such as gross receipts is the same across definitions, different thresholds may apply. Also, for some purposes, the tax code might define a small business in more than one way.  Tax Treatment of Cryptocurrency

Questions surrounding the tax treatment of cryptocurrency are complex. According to recent IRS Revenue Ruling 2023-14, the process of verifying ownership of cryptocurrency is called “ staking.” And when a taxpayer has successfully staked his or her units of cryptocurrency, he or she may also receive “ staking rewards” consisting of additional units. When does the taxpayer have to include those staking rewards in gross income? A cash-basis taxpayer is said to “ gain dominion” over staking rewards received when he or she can sell, exchange or dispose of them. In the year that the taxpayer gains dominion over the rewards, the fair market value of the rewards must be included in gross income.  Customers Paying Late? Send Reminders

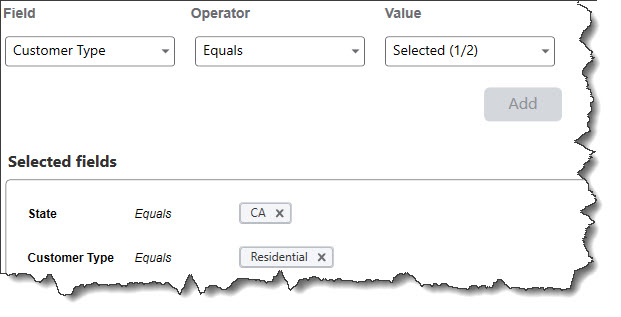

QuickBooks allows you to send Payment Reminders to Customer Groups that you create.QuickBooks supports multiple ways to encourage your customers to pay faster, including allowing online payments and assessing finance charges. It provides reports such as Open Invoices and A/R Aging Detail that can help you determine exactly who is in arrears. There's something else you can do, though: You can send Payment Reminders to alert customers to invoices they need to settle. QuickBooks automates the process of sorting out who's behind and alerts you to actions you should take. It also allows you to create Customer Groups that you can use in this task and for other purposes, like mailing lists. Before you get started, open the Edit menu and select Preferences | Payments | Company Preferences. Answer the questions under Payment Reminders and click OK. Let's look at how this all works. Grouping Customers You can create Customer Groups in the process of sending Payment Reminders, but we'll show you how to do it ahead of time. It's not difficult. You specify the criteria you want to use to find customers that share certain characteristics, such as location, customer type, and account balance. To get started, open the Lists menu and select Manage Groups. Click Create customer group. In the window that opens, enter a Name for your group. Let's create a group for all of your residential customers in California and call it Residential California. Add a Description if you'd like and click Next. In the next window, you can set up your filter by selecting a Field (Status, Open balance, etc.), an Operator (Equals, Not Equals, etc.), and Value (all of the possible options). Click Add when you're done. You can specify multiple filters for each group. Here's what it would look like:

When you're done, click Next to see the resulting table. Check the box at the top if you want QuickBooks to automatically add new members as they meet these criteria or remove them if they don't. Click Finish. Tip: If you want a group that contains all of your customers that you can apply filters to in the future, just click through the window where you assign fields and values. You'll end up with a comprehensive list of your customers. You could also manually select and unselect entries from this list. Sending Payment RemindersLet's say you want to send a statement to your high-balance customers (more than $500 outstanding) who have invoices that are more than 15 days past due. You want the statements to go out on the first day of every month. (Statements, in case you've never used them, are lists of invoices sent and payments received within a specified period of time.) Go to Customers | Payment Reminders | Schedule Payment

Reminders again. Click New schedule in the

upper right corner and select Statement. Click

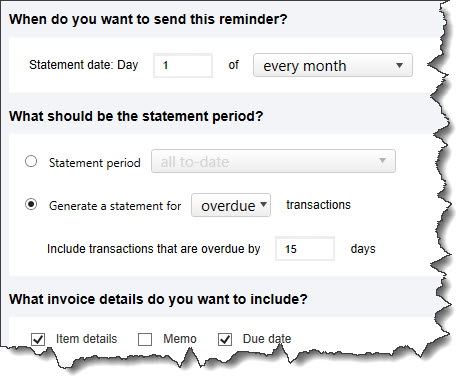

QuickBooks will then display a list of the customers who meet those criteria. You can remove selected entries if you'd like and indicate that you want customers to automatically be moved in and out as their balances change. Click Finish. You'll be back on the Payment reminders page. Find the “High balance 500” entry and click + Add reminder. Fill out the fields in this window as shown below.

You should set up the Add reminder window to resemble this one if you want high balance, overdue customers to get statements on the first of each month. Below this in the same window, you can modify the email and statement templates that will be used or select alternative ones, though the default ones will probably be fine. Be sure to click Editnext to Email template to make sure it says what you want. The fields contained in brackets ([ ]) will change to contain your customer data in your emails, and you can add fields if you'd like. At the bottom of the window, check the box next to Generate a separate statement for each Customer:Job. Click OK. QuickBooks will now send you reminders when it's time to dispatch individual statements. You can see what's scheduled and send your reminders by going to Customers | Payment Reminders | Review & Send Payment Reminders. We hope you don't have to use this feature much to chase down customer payments. But it's there if you need it. And you may find other uses for your Customer Groups.  Upcoming Tax Due DatesOctober 16Individuals - Filing a 2022 income tax return (Form 1040 or Form 1040-SR) and paying any tax, interest and penalties due, if an automatic six-month extension was filed (or if an automatic four-month extension was filed by a taxpayer living outside the United States). Individuals - Making contributions for 2022 to certain existing retirement plans or establishing and contributing to a SEP for 2022, if an automatic six-month extension was filed. Individuals - Filing a 2022 gift tax return (Form 709) and paying any tax, interest and penalties due, if an automatic six-month extension was filed. Calendar-year C corporations - Filing a 2022 income tax return (Form 1120) and paying any tax, interest and penalties due, if an automatic six-month extension was filed. Calendar-year C corporations - Making contributions for 2022 to certain employer-sponsored retirement plans, if an automatic six-month extension was filed. October 31Employers - Reporting income tax withholding and FICA taxes for third quarter 2023 (Form 941) and paying any tax due. November 13Individuals - Reporting October tip income of $20 or more to employers (Form 4070). Employers - Reporting income tax withholding and FICA taxes for third quarter 2023 (Form 941), if you deposited on time and in full all of the associated taxes due.  Copyright © 2023 All materials contained in this document are protected by U.S. and international copyright laws. All other trade names, trademarks, registered trademarks and service marks are the property of their respective owners. |

This set of filters would create a Customer Group

that contains all of your residential customers in California.

This set of filters would create a Customer Group

that contains all of your residential customers in California.

Connect With Us